The deal

Golf’s PGA Tour policy board has agreed to advance investment talks with a new consortium led by Fenway Sports Group (FSG), the US sports ownership group, as negotiations with Saudi Arabia’s Public Investment Fund (PIF) over its proposed merger with the rival LIV Golf circuit comes to a head.

The tour’s board, which consists of six players and five independent directors, unanimously decided to further explore a potential partnership with Strategic Sports Group (SSG) and the tour’s PGA Tour Enterprises project for-profit company, which will be launched should its deal with the PIF succeed.

The consortium is made up of the who’s who in sports ownership.

Along with FSG, which owns English soccer's Liverpool and Major League Baseball side the Boston Red Sox, other investors include Marc Attansio (Milwaukee Brewers), Arthur Blank (Atlanta Falcons), Cohen Private Ventures (New York Mets), Wyc Grousbeck (Boston Celtic), Tom Ricketts (Chicago Cubs), and Marc Lasry (Milwaukee Bucks), as well as Gerry Cardinale, managing partner of RedBird Capital which owns Italian soccer giant AC Milan.

Lasry, Blank, Cohen, and Werner are also team owners in the TGL golf league founded by Tiger Woods, who is part of the PGA Tour board, and Rory McIlroy.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataThe company that the consortium is looking at investing in is PGA Tour Enterprises, the new for-profit company at the center of a framework agreement uniting the PGA Tour, DP World Tour (formerly European Tour), and PIF-backed rival LIV Golf circuit announced in June.

According to the framework agreement, the for-profit assets of the three circuits will be combined into a new subsidiary tentatively called NewCo. After an evaluation of those assets, the PIF, which owns 93% of LIV Golf, will make a minority investment into the new entity.

NewCo will be an umbrella for all future golf-related investments of the three groups and plans to create financial returns through “targeted mergers and acquisitions to globalize the sport.” The PIF, meanwhile, will invest in both the PGA Tour and DP World Tour as a “premier corporate sponsor.”

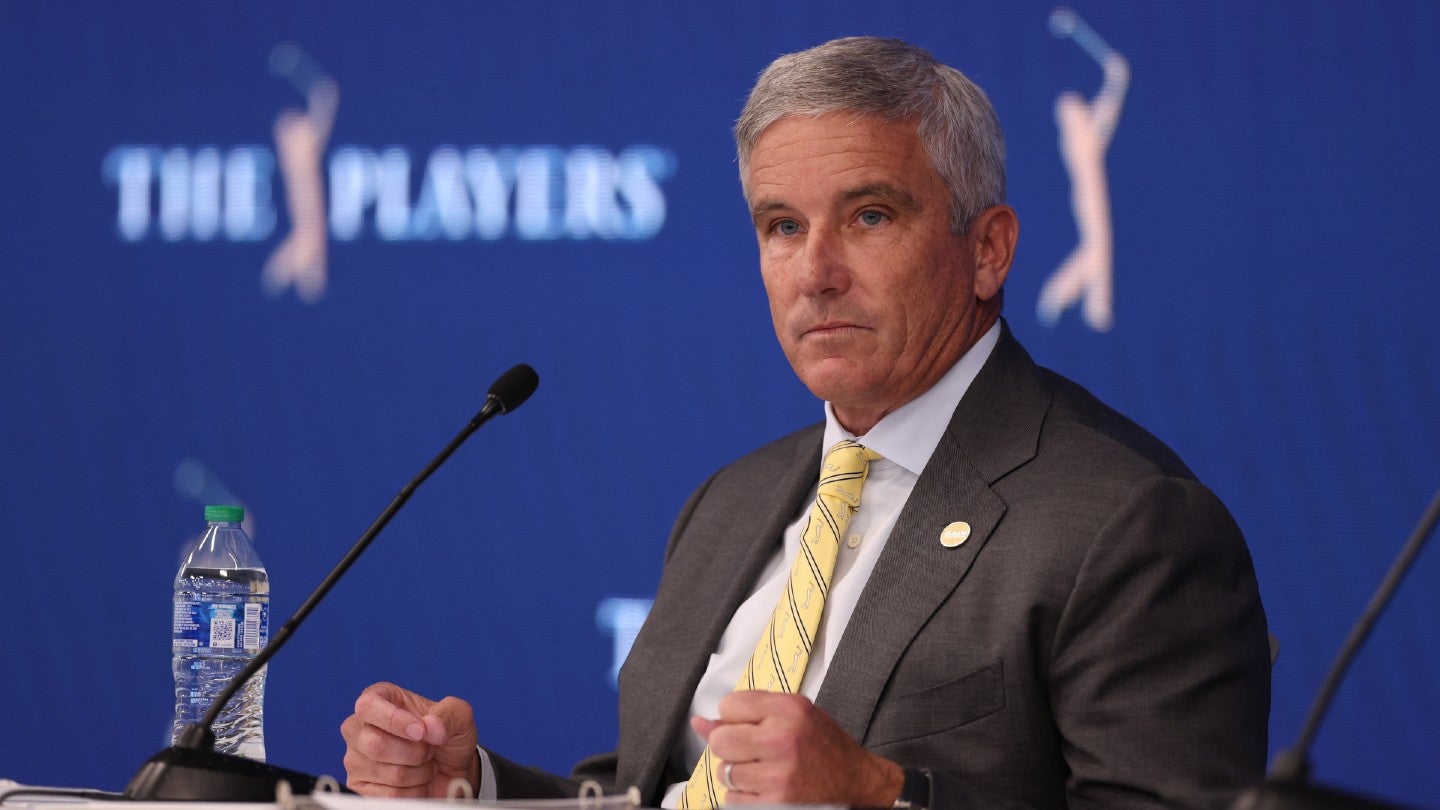

PGA Tour commissioner Monahan would be the chief executive and PIF governor Yasir Al-Rumayyan the chair of the new company. Al-Rumayyan also would have a seat on the PGA Tour board, though the PGA had assurances in the preliminary deal that it would always have a majority vote.

Why it matters

The PGA Tour is hoping its deal with the PIF and any future investments into the new PGA Tour Enterprises will ensure the future success of the tour, having been blindsided by the creation of the rival Saudi-backed LIV Golf last year and its incremental poaching of top talent through lucrative agreements the US tour cannot compete with.

The latest has been Jon Rahm, a former critic of LIV who announced he had joined the Saudi-funded series last week (December 8) in a deal understood to be worth up to £450 million ($563.76 million).

The PGA Tour responded today by announcing his indefinite suspension from the tour – a move which sees him removed from the FedEx Cup eligibility points list.

Conrad Wiacek, head of analysis and consulting at Sportcal (GlobalData Sport), said: “The PGA Tour has reached a realization that in terms of competing with LIV Golf, they simply cannot do so from a financial standpoint.

“With top names being lured away by the riches on offer, the PGA Tour's hopes that tradition and legacy would be enough to secure top talent to commit to them has seemingly failed. To that end, seeking further investment, be it from Saudi Arabia or another source, speaks to the pressure that the PGA Tour finds itself under.

“With an investment group led by FSG but including several other sports team owners across the NFL and MLB, the PGA Tour may be looking to merge with the TGL League, led by Woods as a means of heading off LIV Golf.

“By looking to associate with Woods, the most commercially successful golfer in history, the PGA Tour is hoping that this will drive additional revenue from media and sponsorship agreements to hopefully increase their prize pots, making the money on offer from LIV Golf not so appealing. Whether golf can shake its reputation as a sport for older demographics is yet to be seen.”

The details

Any potential investment by SSG is reliant on the PGA Tour fine-tuning details of its agreement with PIF and securing the deal ahead of the December 31 deadline.

Earlier this year, Monahan expressed his confidence an agreement will be reached in time, however, commentators have become more skeptical as the deadline approaches, and the deal is being more scrutinized as time goes on.

When the potential merger was announced, it took the world by surprise given the PGA Tour and LIV Golf’s bitter public spats and legal disputes. Internally, PGA Tour players and stakeholders, including board members, were left blindsided by the deal and found out at the same time as the media, causing a major rift.

Amid the fallout, players called for Monahan to resign due to the lack of transparency around the deal and the perceived betrayal by the tour of players who had remained loyal to it.

Relations between the tour and its members were thought to have thawed slightly but not entirely after the tour announced Woods as a player director for the PGA Tour policy board, joining players Patrick Cantaly, Charley Hoffman, Peter Malnati, Rory McIlroy, and Webb Simpson. McIlroy has since departed citing his unhappiness with how the deal is progressing.

The addition of Woods meant the six players outnumbered the five independent board members, giving them a bigger voice in future decisions.

However, yesterday (December 12) lawyers representing 21 golfers, including former Masters champion Danny Willet, wrote to the PGA Tour to demand “full disclosure” on ongoing negotiations between the tour and the PIF after being “kept in the dark about this process.”

The letter has demanded “a meeting with independent directors on the policy board to understand the process that has been followed and will be followed going forward. Importantly, we seek assurances that all conflicts of interest will be disclosed.”

Externally, the deal has caught the attention of the US government and is under investigation by the US Senate. Subpoenas were handed out to the PIF’s US subsidiaries in September demanding the release of documents related to PIF’s ‘framework agreement’ with the PGA Tour and “related investments throughout the US” after it refused to voluntarily comply with the Senate’s original request.

A review of PIF’s public filings shows its public US holdings have increased to more than $35 billion compared with around $2.5 billion in 2018.

During the hearing, Blumenthal and witnesses accused Saudi Arabia of exploiting loopholes in certain investment platforms to spread their influence and exert soft power in the US, as well as ‘sportswash’ criticism of alleged human rights abuses back home.

On golf and the PGA Tour’s deal specifically, the subcommittee pointed to problematic language in the proposed framework agreement that allows PIF significant control of the US entity.

While the PGA Tour has maintained its belief that it controls its future as part of its proposed deal, documents released by Congress contain language in the framework agreement that may give Al-Rumayyan the final say over any matters.