North American basketball’s NBA has officially started the process to expand the league for the first time in more than 20 years.

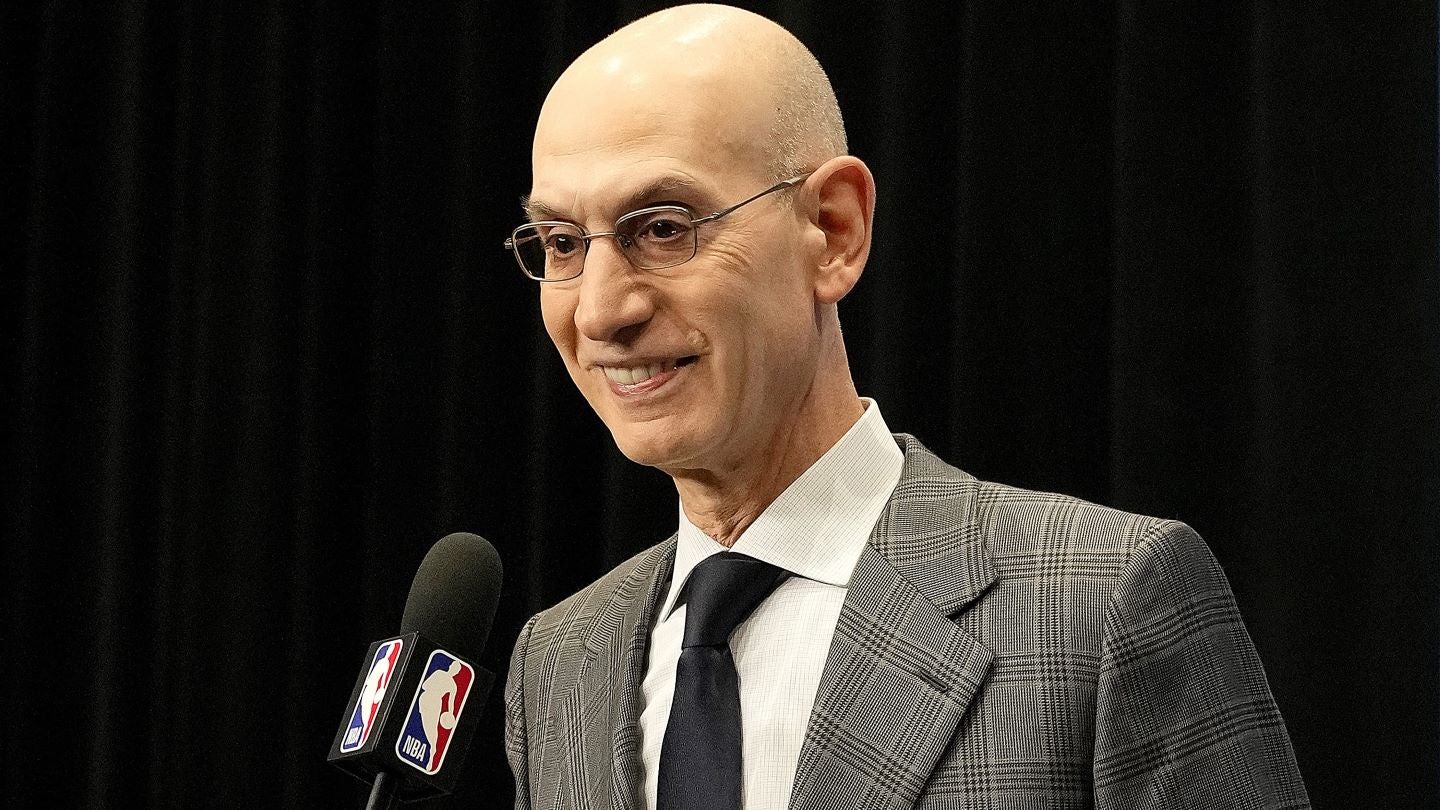

The topic of expansion was discussed at the NBA's board of governors meetings this week, and commissioner Adam Silver said the dialogue about whether to potentially add teams to the league will continue with additional research.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The board of governors, which includes one representative from each of the NBA’s 30 teams, has tasked the league with doing “an in-depth analysis of all the issues around expansion, both economic and non-economic.”

The NBA last expanded in 2004 when a franchise in Charlotte, North Carolina, was added after the Hornets moved to New Orleans. Before that, the NBA added six teams in seven years from 1988 through 1995.

Silver had long said the league would focus on the topic of expansion after signing a new media rights deal, which was finalized last year with Disney, NBC, and Amazon for a record $76 billion over the next 11 seasons.

The NBA commissioner said: “A lot of analysis still needs to be done and nothing's been predetermined one way or another, and without any specific timeline. We're going to be as thorough as possible and look at all the potential issues.”

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataSilver said the process would be led by two existing subcommittees of the league's governors, the combination of the advisory finance committee – which has primary jurisdiction over expansion – and the audit and strategy committee, focused on financial elements.

He added: “A consensus quickly formed that the league office should do the work and work with these particular committees and the board and present that analysis.”

Last month, Silver said expansion “will be on the agenda to take the temperature of the room.”

NBA team values have soared in recent years, which makes the potential addition of teams even more lucrative for the league’s current owners, who evenly share expansion fees.

Those fees are expected to be as much as $5 billion, although that was before the Boston Celtics were acquired for $6.1 billion in March and the Los Angeles Lakers were sold last month at a $10 billion valuation.

According to Forbes, the average value of an NBA franchise is currently $4.4 billion.

Las Vegas and Seattle have long been touted as favorites to land franchise rights should the league expand to 32 teams in the coming years.

Vegas already has strong ties to the league, including hosting its annual summer league tournament.

Seattle has been without an NBA team since the Supersonics moved to Oklahoma for the 2008-09 season, becoming the Oklahoma City Thunder. The Sonics had played in Seattle since 1967.

In Las Vegas, interested parties include a consortium containing Fenway Sports Group, RedBird Capital Partners, and NBA superstar LeBron James. Bill Foley, owner of the NHL’s Las Vegas Golden Knights, is leading an effort, as well as Avenue Capital’s Marc Lasry.

In 2022, Samantha Holloway, co-owner of ice hockey’s NHL franchise Seattle Kraken, said she will pursue her family’s goal of reviving the NBA in Seattle should the league expand.

Although conversations haven't tangibly moved closer to potentially awarding teams, Silver described the latest update as “a significant step.”

He said: “We're now engaging in this in-depth analysis, something we weren't prepared to do before. But beyond that, as I said, it's really day one of that analysis. In terms of price, potential timeline – too early to say. And again, I think that also assumes the outcome of this analysis. It is truly a complicated issue.”

Silver, who has been the NBA’s commissioner since 2014, outlined that the next steps in that analysis include looking at specific markets and investigating the facilities and the “appetite” in those markets.

He also cited the need to study the long-term effects of splitting league-wide revenue, particularly the league's national TV deals, an additional two ways, which he has compared to selling equity in a business.

Silver additionally highlighted the uncertainty about the future of local TV deals for teams, with many regional sports networks collapsing in the country.

He stated: “We would be malpracticing if we didn't figure out how local regional television is going to work before expanding.

“The notion that we would hand over a team into a city where we're not currently operating and say, 'You're going to have to figure out how you're going to distribute your games to your local fans' doesn't make sense.”