Olympique Lyonnais’ (Lyon) financial problems have been laid bare after the beleaguered French soccer club revealed a 24% reduction in revenue for the 2024-25 financial year.

OL Group generated revenue of €273.8 million (€316 million) for the year, down from €361.3 million. The decrease has primarily been attributed to a huge drop in TV rights income.

Discover B2B Marketing That Performs

Combine business intelligence and editorial excellence to reach engaged professionals across 36 leading media platforms.

The Ligue 1 club’s media and marketing rights revenue fell by 52% to €45.7 million, with a reduction in domestic TV rights and the impact of the agreement between global streaming service DAZN and the LFP league organizing body.

The LFP oversaw a disastrous media rights process ahead of the 2024-25 season that resulted in five-year deals with DAZN and pay-TV giant BeIN Sports worth significantly less than the league’s previous broadcast contract.

Last season, DAZN was covering eight fixtures per week through a €325 million deal, while BeIN Sports aired the other game, via a contract running through 2025-26 worth a total of €100 million.

The LFP tanked its domestic broadcast rights outlook by overestimating the value of its package, resulting – for example – in last marking the first time since 1984 that French broadcasting heavyweight Canal Plus did not air live Ligue 1 matches.

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataThe league’s agreement with DAZN has now collapsed, with the streaming platform opting to terminate its contract four years early.

As such, it is likely that for the 2025-26 season, many of the clubs (outside perennial champions Paris Saint-Germain) will be operating on severely reduced budgets, which will further hamper a financially stricken Lyon team.

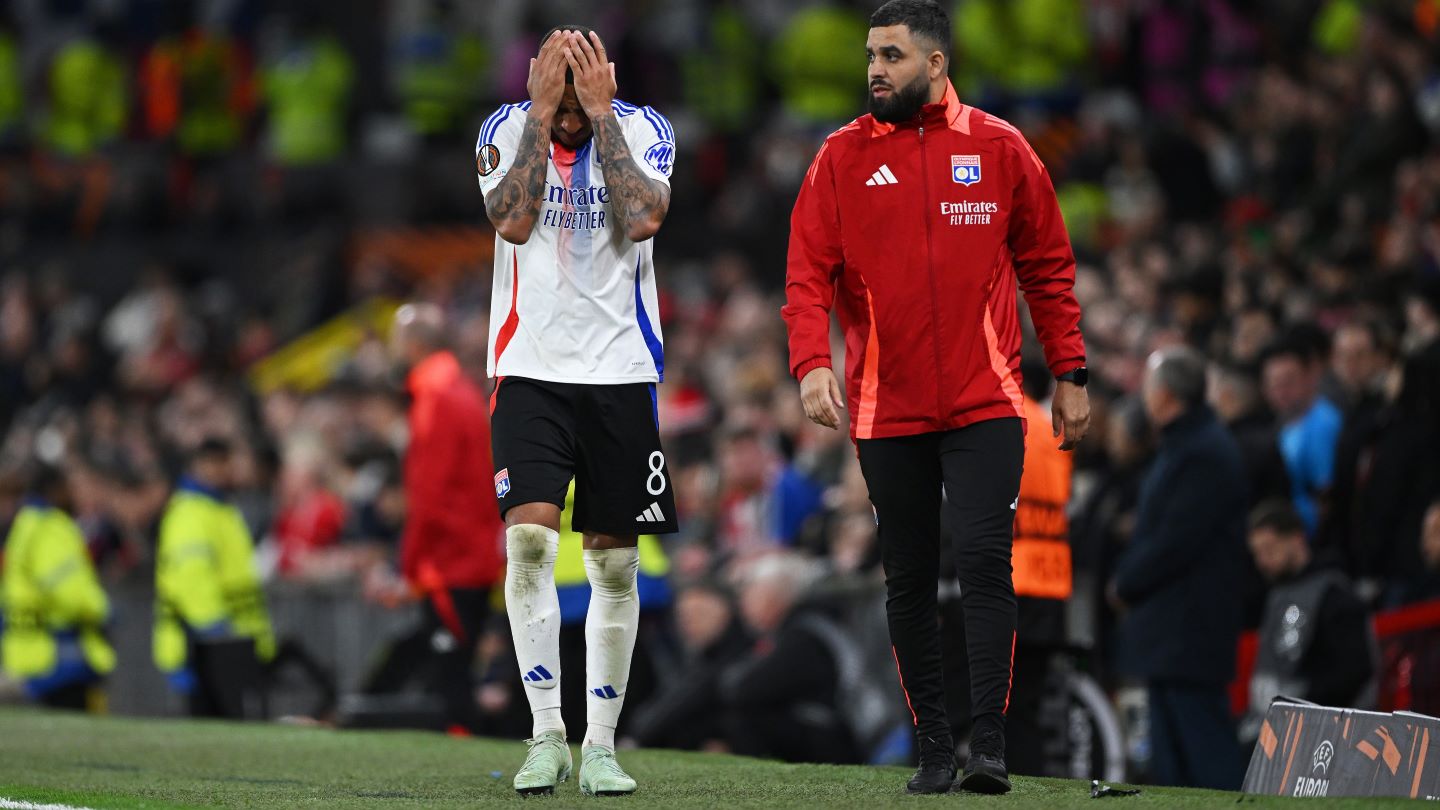

Lyon were recently demoted to the second-tier Ligue 2 by the country’s DNCG financial monitoring body for financial mismanagement but had that decision overturned on appeal earlier this month to remain in Ligue 1.

After the initial ruling and the launch of Lyon’s appeal in June, the club reshuffled their executive management, with minority investor Michelle Kang, majority owner of the associated women’s team OL Lyonnes, stepping in as president as American John Textor resigned from the role.

Kang is said to have played an “active” role in the successful appeal.

Despite Lyon announcing record revenue in their 2023-24 financial reports, parent company Eagle Football Group’s financial results for the same period, however, showed that it accrued €505.1 million in financial debt, which prompted the initial ruling by the DNCG.

Despite the ongoing financial challenges, the club recorded a significant increase in ticketing revenue for 2024-25, up 26% to €42.8 million, particularly thanks to their participation in the Europa League secondary club competition.

Lyon’s commercial revenue for the year, however, was down 18% to €30.4 million. The team also saw drops in brand revenues (down 55% to €29.6 million) and events (down 57% to €24.7 million).

In a major boost to the club, insurance company Groupama has renewed its stadium naming rights agreement for another five years.

The firm has sponsored the stadium since 2017, and its previous deal with the Ligue 1 club, signed in 2021, was due to expire at the end of this month.

The long-term extension will run until 2030. Financial terms of the new deal with Groupama were not disclosed, but the previous contract was reportedly worth between €5 million and €6 million per year.

There had been doubts over the continued relationship between Groupama and Lyon due to the club’s well-documented financial troubles.

Groupama Stadium opened in 2016 and was used as a host venue during the men's UEFA European Championship later that year, as well as the 2019 FIFA Women’s World Cup.

In May, it was announced that OL Lyonnes will play their home matches at Groupama Stadium from next season.