Overview of Nike’s Branding Strategy, Key Factors Driving Brand Success

Executive Summary

1. Nike uses sponsorship to retain position as the most recognisable sportwear brand on the planet

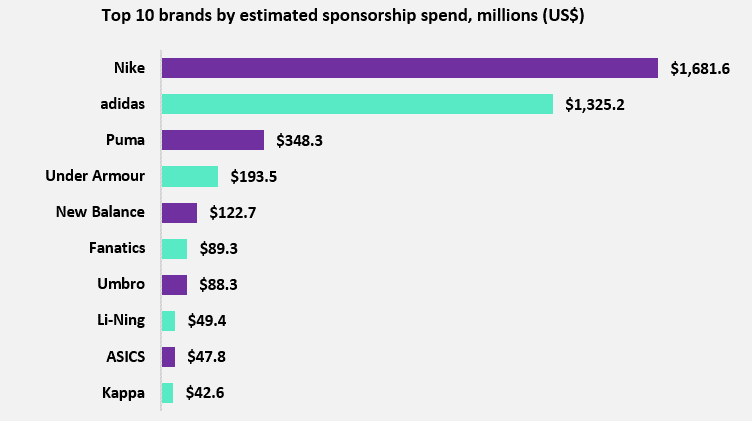

- Analysis of 293 active deals by Nike taken from the Sportcal Intelligence Centre, totalled an estimated annual sponsorship spend of $1.68 billion. It is however expected that Nike’s overall sponsorship spend is far higher than this.

- Nike spares no expense on sponsorship and marketing, aligning itself with the biggest athletes, teams and events from across the world of sport.

2. Nike & Liverpool pay-for-performance contract the blueprint for future kit supply deals

- Nike’s new kit supplier contract with Liverpool has shaken up the kit supply market. The deal offers a lower annual fee than previous supplier New Balance, but a higher commission of 20%, whilst cash bonuses for on-field performances have increased.

- Despite offering a lower base fee than New Balance’s current contract with Liverpool, Liverpool chose to go with Nike due to their marketing nous and the belief they will generate the level of sales that to make the deal more profitable than what New Balance could.

- Pay-for-performance contracts such as Nike and Liverpool’s are likely to be the blueprint for future kit supply deals due to a decrease in competitiveness for kit supply contracts from challenger brands, which has been intensified by COVID-19, and a shift towards more transparency and accountability in the sponsorship market.

3. The Last Dance gives Nike and the Jordan brand valuable exposure during sporting hiatus

- At a time where the value of Nike’s sponsorship portfolio has greatly depreciated due to the sporting blackout, the Last Dance has given Nike and the Jordan brand some valuable exposure, whilst providing a competitive advantage over struggling rivals.

- Analysis by data insight company GumGum, who calculated that in the fifth episode of ‘The Last Dance’, the Nike and Jordan brand logo appeared over 100 times and received more than nine minutes of exposure, worth $487,000.

4. Despite the financial implications of COVID-19, Nike’s sponsorship budget is likely to be held

- Nike’s sponsorship strategy of targeting kit supply deals with some of the world’s leading clubs in strategically important markets for the brand e.g London, Barcelona & Paris, has provided much needed awareness that has fostered the growth of Nike’s online business and digital presence in these locations.

- As a result, Nike has experienced higher-than-expected demand on its digital side of the business, which has been accompanied by Nike’s strategic shift to the direct-to-consumer channel, including digital storefronts like its app and website.

- Sponsorship budgets are thus likely to be held; Carl Davies, managing director at Perry Ellis International, told Sportcal: “Both Nike & Adidas are very clear on their short-term & medium-term strategy, COVID-19 is a short shock for them but one they see as coming out stronger from within 12 months.”

Key Information

- Founded: 1964

- HQ location: Beaverton, Oregon

- Industry: Sportswear / Apparel

- Subsidiaries:Jordan, Converse, Hurley

- Annual Revenue 2020:$37.4 billion (4% decrease vs 2019)

- Main rivals: Adidas, Puma, New Balance, Under Armour>

Background

NIKE Inc (NIKE) designs, markets and distributes athletic footwear, apparel, equipment and accessories for men, women and children. It markets and distributes various products for kids and for other recreational and athletic activities such as football, baseball, cricket, lacrosse, skateboarding, tennis, volleyball, wrestling, walking and outdoor activities and various apparels with licensed college and professional team and league logos. The company markets these products under various brands including Nike, Jordan, Hurley and Converse, for a few.

Nike sells these products through the company-owned retail stores, e-commerce portals, independent distributors, licensees and sales representatives located worldwide. It also merchandises these products through its e-commerce portal nike.com. It has presence in North America, Central America, South America, Asia-Pacific, the Middle East, Africa and Europe regions. Nike is headquartered in Beaverton, Oregon, the US.

Strategy

Active deals analysed: 293

Estimated annual value: $1.68 billion

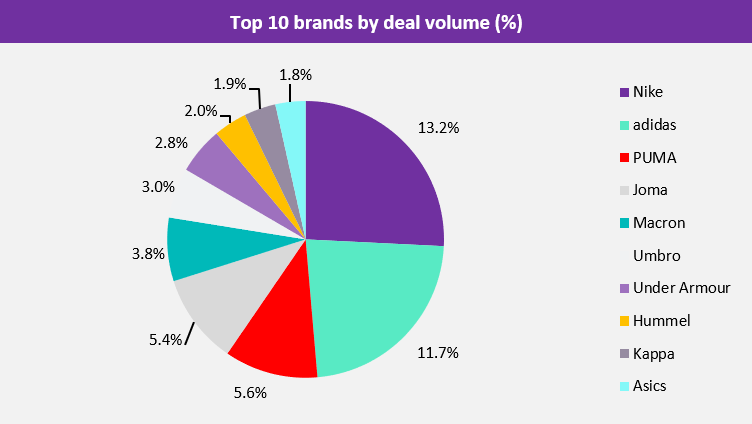

Nike uses sponsorship to retain its position as the most recognisable sportswear brand on the planet, staying ahead of perennial rivals Adidas and Puma and smaller brands such as Under Armour and New Balance. As such, Nike spares no expense on sponsorship and marketing, aligning itself with the biggest athletes and events from across the world of sport.

The following analysis is based on the study of 293 active deals by Nike taken from the Sportcal Intelligence Centre on 18th June 2020, totalling an estimated annual value of $1.68 billion. It is however known that the brands portfolio is even more vast – in 2016, Nike is reported to have spent in excess of $9 billion on endorsements over the 12 month period.

How well do you really know your competitors?

Access the most comprehensive Company Profiles on the market, powered by GlobalData. Save hours of research. Gain competitive edge.

Thank you!

Your download email will arrive shortly

Not ready to buy yet? Download a free sample

We are confident about the unique quality of our Company Profiles. However, we want you to make the most beneficial decision for your business, so we offer a free sample that you can download by submitting the below form

By GlobalDataAccording to Sportcal’s Intelligence Centre, Nike is the most significant player in the apparel sector in terms of prevalence and expenditure, as demonstrated in the graphs below. Sportcal estimate Nike to spend $1.68 billion across 293 sponsorship deals, over $300 million more than rivals Adidas and over $1 billion more than the next biggest spender, Puma. Nike are responsible for around 35% of the total apparel sponsorship market value.

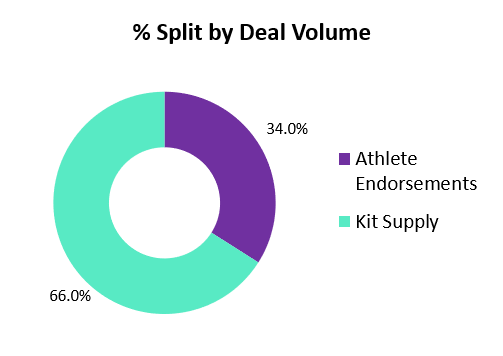

Nike sponsorships come in the form of athlete endorsements and kit supplier partnerships with teams, leagues and competitions across the world.

Activations take place across all media but special emphasis is placed on digital platforms – regularly producing marketing videos and other forms of media that are shared by fans all over the world. Nike’s sponsorships and athlete endorsements are integral to these activations in terms of relaying Nike’s campaigns to millions of fans across a range of platforms, amplifying Nike’s messaging to new markets and accessing new customers.

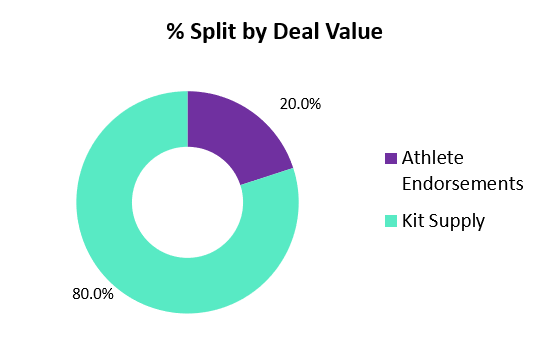

Kit supplier partnerships form the majority % split of deals by value and by volume for Nike. Kit supplier partnerships typically command much higher sponsorship fees than athlete endorsements.

- Kit supplier partnerships account for $1.34 billion (80%) of Nike’s total sponsorship expenditure

- Athlete endorsements account for $336.8 million (20%) of Nike’s sponsorship spend

- 66% (194 deals) of Nike sponsorships are kit supplier deals with teams, leagues, federations and competitions

- 34% (99 deals) of Nike sponsorships are athlete endorsements

Kit Supplier Partnerships

Kit Supply Overview

Deals:194

Estimated annual spend:$1.34 billion

Kit supplier partnerships are a fundamental aspect of Nike’ global marketing strategy, forming 80% of the brand’s total sponsorship expenditure. Engaging in kit supplier deals provide Nike with the visibility and growth opportunities a brand of its size desires.

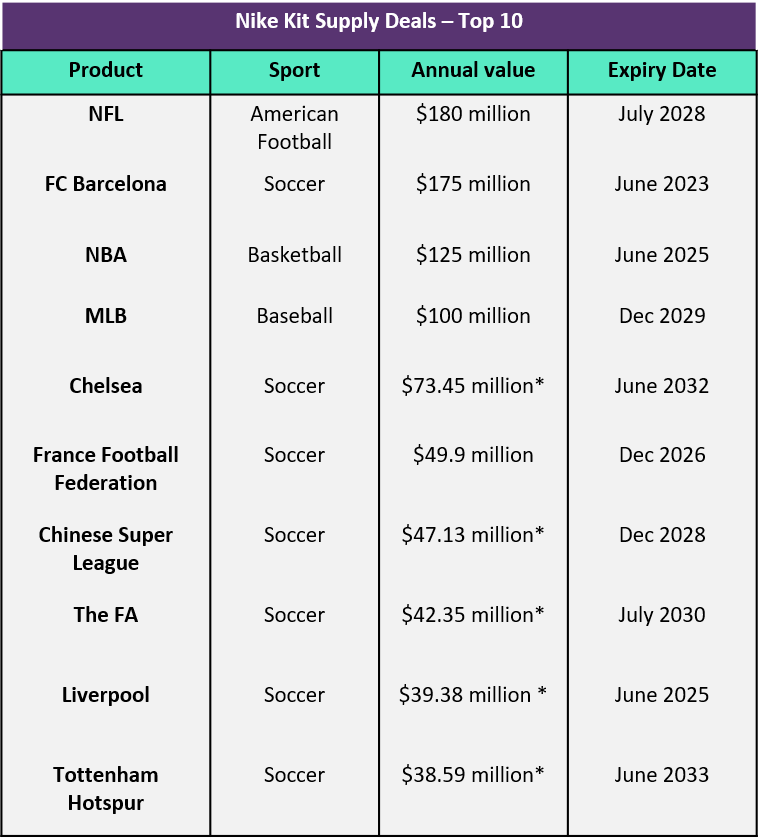

In the US, Nike partners with the premier sporting leagues, the NFL, NBA and MLB, as kit supplier to the leagues and teams within them, all of which have commanded annual fees north of $100 million. In 2018, Nike signed an 8-year extension as the kit supplier to the NFL for the 2020-2028 period, which Sportcal estimate to be worth at least $180 million per-year, making it the most lucrative kit supplier contract in the history of sport.

Nike use a geographical approach to the targeting of kit supplier deals in soccer, whereby the US sportswear giant targets teams in key cities around the world e.g London (Chelsea & Tottenham Hotspur), Paris (PSG), Milan (Inter Milan), Barcelona (FC Barcelona), Madrid (Atletico) and Rome (AS Roma). Kit supplier deals in major cities is vital for Nike in terms of the growth of their digital presence in London, Barcelona, Paris etc, which has been crucial throughout the outbreak of COVID-19 as it has fostered the growth of Nike’s e-commerce business in strategically important markets for the brand.

Nike spent an estimated $356 million on kit supply in the top-two divisions in English, French, German, Italian and Spanish soccer in the 2019/20 season. The kit supplier deal with FC Barcelona, which Sportcal estimate to be worth around $175 million per-year, is the most expensive kit supply deal in the history of soccer.

Nike also forms kit supplier partnerships with international federations in key markets for the brand, such as the USMNT, the Chinese FA & Chinese Super League, European nations such as England and France and Brazil in South America. Nike’s swoosh logo can thus be visible across the world.

Nike switch up the kit supply game in move towards pay-for-performance contract

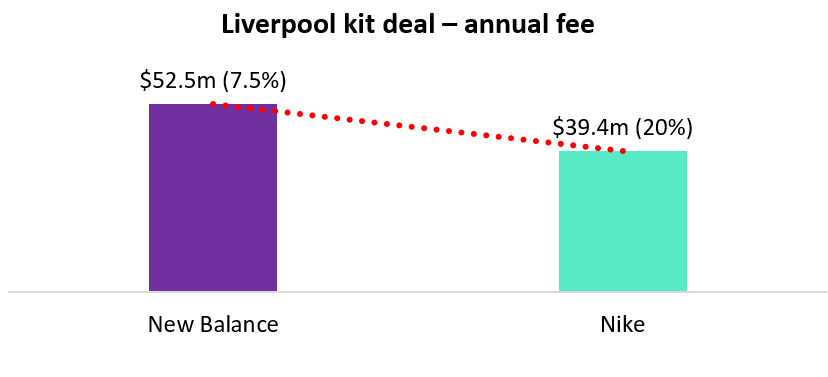

In 2019, Nike’s new kit supplier deal with Liverpool hit the headlines due to the nature of the contract and the fallout with current Liverpool kit supplier New Balance. As New Balance’s $52.5 million per-year deal approached expiry, Nike came circling as the European Champions looked to improve the terms of their current deal. The outcome of the negotiations was that Liverpool chose to drop New Balance in favour Nike, agreeing a five-year deal in principle. Despite New Balance’s objections to the deal on the basis of a ‘matching clause’ in their current contract, which led to a court case, Nike were awarded the contract due to their superior stable of athletes which can be used in future marketing campaigns.

The Contract

- Annual fee: £30 ($39.4) million

- Commission: 20% on each £1 ($1.30), reduced to 5% for footwear

- Bonus:

£4 ($5.2) million bonus for winning Champions League

£2 ($2.6) million for reaching the Champions League Final

£2 ($2.6) million for winning the Premier League

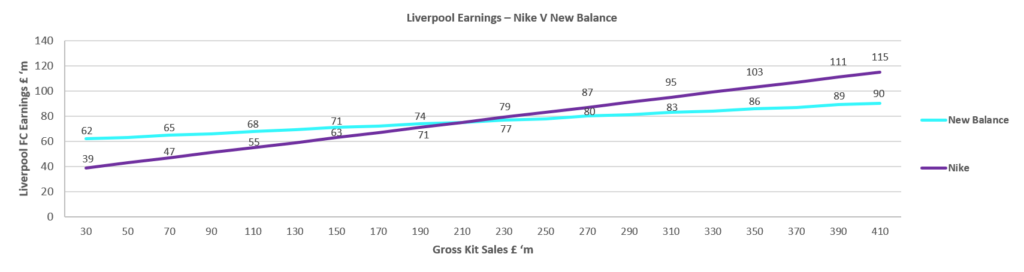

Nike in its new kit supply deal with Liverpool has changed the kit supply market. Typically, brands will pay teams/federations an up front fee whilst offering around 7.5% on each £1 ($1.30) of sales. However, Nike’s deal with Liverpool offers a lower annual fee than previous supplier New Balance, but a higher commission of 20%, whilst cash bonuses for on-field performances have increased. As portrayed by the chart in the below slide, once gross kit sales hit a certain level (approximately £210 million), this model of kit sponsorship will become more profitable for the European soccer champions. Ultimately, Nike’s marketing nous and the belief they will generate the level of sales that to make the deal more profitable than what New Balance could offer is what awarded them the kit supplier contract with Liverpool.

For Nike (and kit suppliers in general), a more pay-for-performance type contract is preferable as revenues are less susceptible to negative team performances and changes in consumer behaviours. On this occasion Nike was able to negotiate the agreement towards this type contract as despite the challenge of New Balance it knew Liverpool wanted to strike a deal with themselves, mainly because it was the only brand able to properly satisfy Liverpool’s desire for a vast and worldwide distribution network. It therefore held the power in negotiations. Additionally, as mentioned, Nike was able to successfully pitch that with its marketing nous, the contract will still generate a greater profit for the Merseyside club.

On the whole however, we anticipate Nike to be able to be able to continue striking deals in this manner and drive down the value of kit supply deals in general. This is mainly due to a decrease in competitiveness for kit supply contracts from challenger brands, such as Under Armour and New Balance, as they have stopped bidding for as many contracts as they fail to make the numbers work.

Meanwhile, the detrimental impact of COVID-19 on the apparel sector as a whole will see a further drop in the number of brands bidding for agreements, handing further negotiating power to Nike. The deal also forms part of a shift towards transparency and accountability in the sponsorship arena and Sportcal expect the Nike and Liverpool pay-for-performance contract to be the blueprint for future kit supply deals for Nike and the wider kit supply market.

Nike show commitment to esports through kit supply agreements

Esports sponsorships, like to other non-endemic brands, have become an intriguing, and attractive proposition due to the potential to reach a millennial demographic, a market which is traditionally difficult to reach through other sports, or indeed any other traditional marketing medium.

Nike has been the most significant mover in the apparel market. The sportswear giant tapped into the lucrative market of League of Legends in China through signing a four-year deal in February last year, worth a reported $7.48 million annually. The agreement sees Nike supply kit for all 16 teams in the LOL Pro League , supplying them with trainers, casual clothing and professional jerseys. This deal is estimated to be the largest deal signed by an apparel brand in esports today.

Nike’s investment in the space continued into 2020, announcing a further three sponsorship agreements with esports properties in January. This includes a deal with T1 Entertainment and Sports, a major Korean esports venture. As T1’s exclusive apparel partner, Nike designs kits for all teams under the T1 stable. In addition, Nike will provide training facilities at T1’s headquarters in Seoul, which is set to open later this year.

The apparent intrigue of esports to apparel brands is likely to be furthered by the COVID-19 crisis.

Nike set to lose BCCI kit supply deal

Nike, one of the oldest sponsors of the Board of Control for Cricket in India (BCCI) in a partnership that dates back to 2006, look set to lose their kit supplying rights of the Indian cricket team. The current deal, worth ₹778.31 million ($12 million) per year is set to expire this September, however Nike are seeking a contract extension beyond the current contractual end date due to lost time, in addition to a discounted price due to the impact of the pandemic on its business.

It is reported that the BCCI are unlikely to agree to such terms, which could signal the end of the long-term partnership between Nike and the BCCI. It gives an insight into the impact COVID-19 has had on Nike’s sponsorship ability, and whilst it is not expected that its overall sponsorship will fall, Nike are unlikely to continue deals not on their terms.

Athlete Endorsements

Athlete Endorsement Overview

Deals: 99

Estimated annual spend: $336.8 million

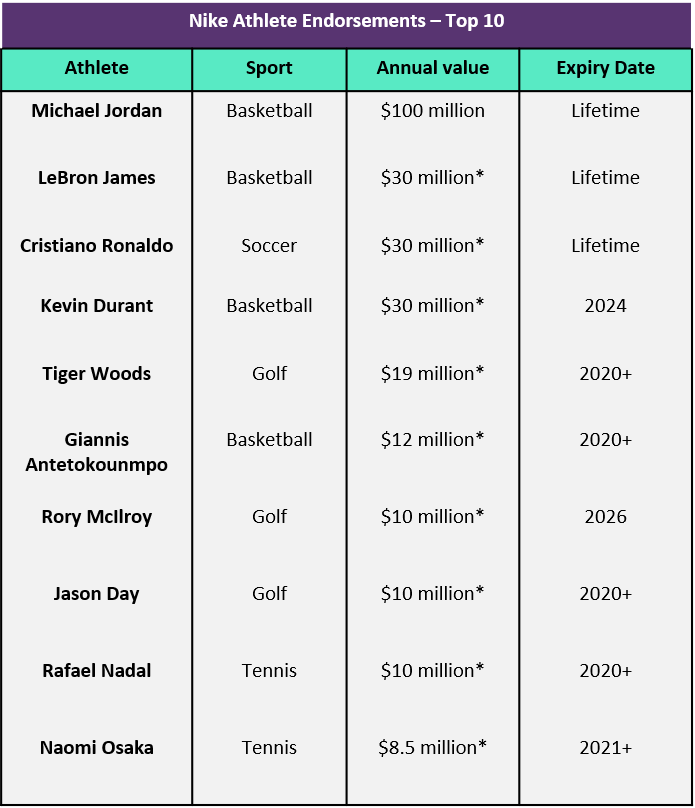

Besides Nike’s extensive kit supply portfolio, Nike is perhaps best-known for its lucrative athlete endorsements with some of the most iconic sportsmen and women on the planet. Boasting the likes of Michael Jordan, Lebron James, Cristiano Ronaldo, Tiger Woods and Serena Williams, Nike’s athlete endorsement portfolio associates itself with premier athletes across a range of sports and allows Nike to transfer ideals of prestige, quality and performance to its brand image. For years, athletes have been the gateway for brands to tap into their fan base and reach their target demographic, but the rise of social media has amplified their influence to unprecedented levels, making athletes more monetizable than ever.

Nike have taken athlete endorsements to new heights by signing lifetime agreements with Michael Jordan, Lebron James and Cristiano Ronaldo. Signing lifetime contracts, all of which have commanded contracts north of $1 billion, demonstrates the value that athlete endorsements can deliver Nike. For example, Cristiano Ronaldo has a unique global influence that other athletes cannot compete with. He is the most followed athlete on social media, with over 435 million followers across Facebook, Instagram and Twitter. In 2016, his social media presence generated $474 million for Nike. His most valuable post was after winning Euro 2016 with Portugal as captain, with Nike’s Just Do It slogan as the caption and the Nike swoosh featured in the image. The post saw 1.75 million likes, nearly 13,000 comments and generated $5.8 million in media value for Nike [1].

Nike place high value on NBA players as endorsement partners due to their significant influence on fashion and pop culture, which ties into Nike’s growing emphasis on lifestyle and culture. Nike also target highly marketable athletes across popular global sports with large social media followings such as golf legend Tiger Woods, Brazilian soccer star Neymar Jr and NFL wide receiver Odell Beckham Jr.

An extensive athlete endorsement portfolio has been vital for Nike during COVID-19. Stay at home measures have amplified the importance of a strong digital presence and athlete endorsements have provided Nike a platform to access millions of consumers worldwide through their sizable social media followings. They have been a central aspect of Nike’s COVID-19 campaign #PlayForTheWorld and #TheLivingRoom cup, which is detailed later in this analysis.

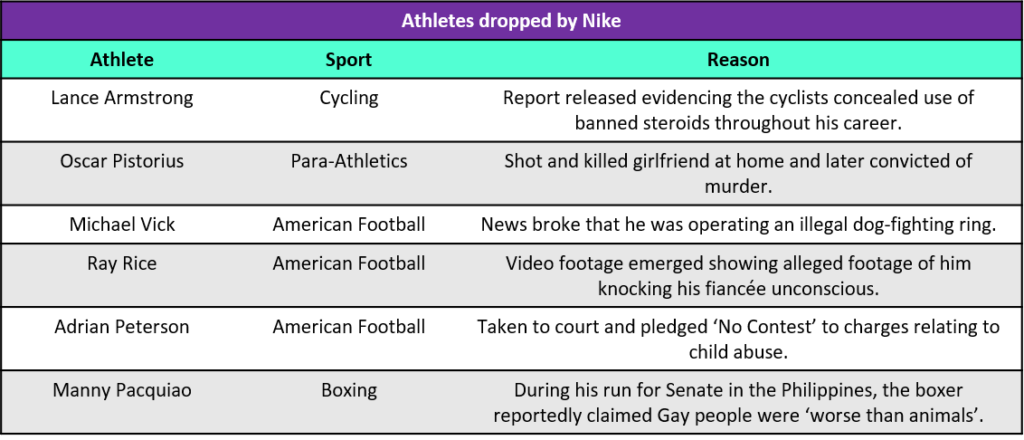

The problematic aspect to athlete endorsements

An extensive athlete endorsement portfolio can however have its problems. In the past, there have been instances when athletes have hit the headlines for the wrong reasons and as a result, Nike has had to drop partnerships due to their involvement in scandals in an attempt to distance itself from any negative brand associations. This included Oscar Pistorius, the South African Paralympic athlete, who was sent to jail for killing his partner in 2014, and Lance Armstrong in 2012 after the cyclist became embroiled in doping allegations.

The significance of the Nike Jordan brand

No athlete endorsement exemplifies the successes of a strong relationship between a brand and athlete than that of Nike and Michael Jordan. In 1984, Nike signed Jordan in what Nike founder Phil Knight claimed to be the best decision he ever made, whereby Jordan became the first athlete to transcend sport and become a brand in his own right. At the time, Nike was a struggling brand that sold running shoes, but their desire to build an entire line around Jordan, the most sought after rookie in the NBA, is what led him to choose Nike over rivals Adidas and Converse.

What followed has changed the athlete endorsement landscape forever, combining on and off court fashion and igniting a sneaker culture which remains to this day. Just a month after Nike released their first Air Jordan shoes in 1985, they had sold $70 million worth of the shoes and by the end of the year, this had risen to $100 million[2]. Nike have released a signature Jordan shoe every year since.

The growing stature of Jordan as a brand throughout his time in the NBA and his legacy since retirement cannot be understated in terms of its importance to Nikes growth, playing a significant role in propelling Nike to the forefront of the sportswear and apparel sector. This is exemplified by the fact that 20 years on from his retirement, the Jordan name and the Jumpman logo are still recognised across the planet. Currently, the Jordan brand alone brings in roughly $3 billion a year for Nike[3] and the brand also recorded its first billion dollar quarter last December [4].

Almost two decades on since Michael Jordan last appeared in the NBA, more Jordan branded shoes and apparel are being sold than the signature lines of ever other current NBA player combined [5]. It is therefore no surprise to see Nike sign lifetime ‘Michael Jordan-style’ deals with Lebron James and Cristiano Ronaldo in an attempt to recreate another dynasty for the brand, whilst also giving marketable athletes such as Neymar Jr his own Jordan collaboration and Nike collections.

It hasn’t always been growth and success for the Jordan brand however; it suffered a short decline in 2014 due to increased competition which suppressed Nike and Jordan’s momentum in the sportswear and sneakers department, accompanied by fashion’s deviation from basketball-inspired clothing. Since, the Jordan brand has looked to collaborations as a means of resurgence. Celebrity partnerships such as with US rapper Travis Scott and an entry into the gaming market through a partnership with Fortnite have enabled Jordan to connect to a younger audience, meanwhile the release of new versions of retro styles has helped the brand reconnect with older fans.

Jordan has also partnered with French soccer powerhouse Paris Saint-Germain (PSG), who have a reputation as ‘the culture club’, through Nike’s kit supply deal with the club to produce Jordan x PSG branded kits and apparel worn in the UEFA Champions League. It was the first time that a brand with unrivalled credibility from outside football entered the game, which has paved the way for more fashion brands to enter sport, such as Palace and Juventus [6].

The Last Dance gives Nike and the Jordan brand valuable exposure during the sporting hiatus

After the airing of the ESPN and Netflix series ‘The Last Dance’, which documented Michael Jordan and the Chicago Bulls’ quest for a historic second ‘three-peat’, the relevance of Jordan, the Jordan brand and Nike has skyrocketed. 23.8 million international households tuned in to the Last Dance on Netflix during its first 4 weeks, whilst Twitter have stated that more than 11 million tweets were posted as the series aired. The docuseries also introduced Michael Jordan to a generation that never got to see him play.

The exposure given to Nike and the Jordan brand throughout the series is illustrated through analysis by data insight company GumGum, who calculated that in the fifth episode of ‘The Last Dance’, the Nike and Jordan brand logo appeared over 100 times and received more than nine minutes of exposure, worth $487,000[7]. The value of this exposure for the Nike and Jordan brands cannot be understated in the midst of the global sporting blackout, which has severely depreciated the value of other sponsorship deals and athlete endorsements for Nike, which, in a normal world, would provide the brands the desired visibility. Nike capitalised on the release of the series by dropping a ‘Fire Red’ Air Jordan 5s on the night of the premiere and sales of nearly every product associated with the six-time NBA Champion have hit new heights since.

Nike haven’t released any sales data related to its Jordan branded products, but data from resellers can provide an insight into the spike in popularity for Jordan branded products. Companies like StockX, an online marketplace and clothing reseller, are seeing record breaking sales – an unsigned version of Air Jordan 1s are currently selling on their site at an average price of $7,123. Prior to the documentary, they hadn’t sold this sneaker since 2017, which at that point was going for $3,000, less than half the current average price. In total, the company said Jordan Brand sneaker sales are up 38% and have shown more than a 100% increase in resale value [8]. Michael Jordan’s game-worn Nike Air Jordan 1s from 1985 sold for more than half a million dollars at an auction in May 2020 – the most ever paid for a pair of sneakers.

This increase exposure and demand for Jordan branded products has been a blessing for Nike in a time where the apparel industry takes a hit from the COVID-19 pandemic due to forced retail closures and financial hardship across the world, and has provides the sportswear giant an increased competitive advantage over its rivals at a time when everyone is struggling.

Emotional Branding

Emotional branding forms a central part of Nike’s sponsorship strategy

Nike’s ascent to the top of the food chain in the last few decades has derived from its strong use of marketing, new technology and use of emotional branding. The latter in particular has become a major area in which the brand has exploited in recent years to generate noise around sensitive areas and heighten its relevance. In 2018, the brand made their bold stance in showing support to ousted NFL quarterback Colin Kaepernick, who had himself made a political stance which remains a hotly debated topic across the globe.

In affiliating itself with Kaepernick, Nike created a new campaign that centred on the QB’s political protest, entitled ‘Dream Crazy’, using the story to highlight its support of racial equality, for which it was also able to use a number of its other big-named sports ambassadors, such as Lebron James and Serena Williams to create a strong story line. The advert generated $163.5 million in earned media, a $6 billion increase in brand value and a 31% boost in sales[9].

COVID-19

At a time where everyone’s day-to-day life has been disrupted, Nike has attempted to unite athletes and the general public through a campaign called #PlayForTheWorld, encouraging people and athletes alike to exercise at home in an effort to stop the spread of COVID-19 and maintain consumer engagement. Once again, athlete endorsements have been vital for Nike in terms of amplifying the message and driving consumer engagement, but this time Nike have positioned them alongside unknown fitness fans to portray the message that we are all in this together.

Nike’s #TheLivingRoomCup has used their endorsed athletes to set challenges for users to take part at home, such as Cristiano Ronaldo’s ‘core crusher’ ab workout, with the aim of giving people the chance to compete against their idolised global athletes from their home. Through combining their athlete endorsements and emotional branding strategy, Nike has been able to drive digital consumer engagement with an authentic, carefully constructed message that aligns with Nike’s fundamental brand values, all without being seen as using the global pandemic as an opportunity to capitalise on the market.

Black Lives Matter

In response to the horrific murder of George Floyd by a white Minneapolis police officer Nike have been one of many brands to come out in support of the Black Lives Matter movement. Through the #UntilWeAllWin campaign, Nike have put a spin on their ‘Just Do It’ slogan, through releasing a video which starts out with ‘For once, don’t do it’, in relation to police brutality in the US and across the world. Once again, the use of their athletes to promote the campaign has been integral in amplifying Nike’s message and heightening its brand relevance.

LeBron James, one of Nike’s marquee endorsers has been a leading voice in the fight against police brutality and systemic racism in the US, whilst the campaign was also reshared by rivals Adidas. In addition to the campaign, Nike announced a $40 million commitment over the next 4 years to support the black community in the US and have declared Juneteenth day an annual paid company holiday in a nod to race relations. Moreover, Michael Jordan and the Jordan brand have announced they will donate $100 million over the next 10 years to organisations dedicated to ensuring racial equality. Considering that throughout Jordan’s career, he consistently refrained from talking about social or political issues, this statement is all the more significant.

COVID-19

Despite hit to finances, Nike expected to keep up sponsorship spend

Nike has not be immune to the negative financial implications of COVID-19, reporting a $790 net loss in Q4 of Nike’s 2020 fiscal year as a result of forced physical retail closures. However, in spite of the negative effect COVID-19 is having on sales for 2020, Nike’s sponsorship budgets is likely to be held.

Carl Davies, managing director at Perry Ellis International, told Sportcal: “Both Nike & Adidas are very clear on their short-term & medium-term strategy, COVID-19 is a short shock for them but one they see as coming out stronger from within 12 months.”

Sponsorship strategy has positioned Nike well to ride out threat of COVID-19

Nike’s sponsorship strategy of targeting kit supply deals with some of the world’s leading clubs in strategically important markets for the brand e.g London, Barcelona & Paris, has provided much needed awareness that has fostered the growth of Nike’s online business and digital presence in these locations. This has been vital throughout the COVID-19 pandemic as digital business streams have become essential for brands to ride out the crisis. As a result, Nike has experienced higher-than-expected demand on its digital side of the business, reporting a 75% surge in online sales, which has accompanied Nike’s strategic shift to the direct-to-consumer channel, including digital storefronts like its app and website.

Nike’s competitors struggle

Whilst Nike has positioned itself well to get through the COVID-19 pandemic, reporting fiscal third-quarter sales that topped expectations, competitors have taken a huge financial hit. Adidas’ net profit and sales sharply fell in its first quarter, and it warned that the second quarter should be even more severely hit by the coronavirus pandemic. The German sporting-goods company said net profit for the period was 31 million euros ($33.5 million), down 95% from EUR632 million a year earlier. Sales fell about 19% to EUR4.75 billion as the pandemic forced Adidas to close shops in Asia-Pacific during the period as well as in the rest of the world in March due to numerous lockdowns, it said [10].

Smaller, ‘challenger’ brands such as Under Armour, who were struggling anyway after failing to see returns on costly sponsorship investments, have also seen their shares slump about 75% on the level 5 years ago [11]. As Nike’s competitors struggle, this will give the brand increased bargaining power when negotiating new sponsorship deals and allow Nike to continue to drive down the cost of sponsorships, reinforcing Nike’s position of power on the market.

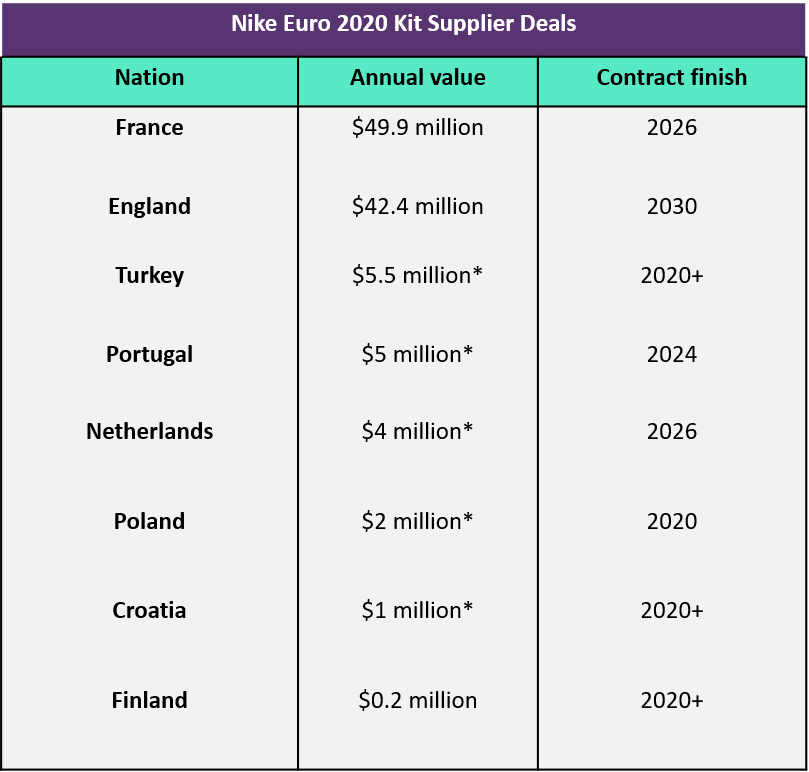

Euro’s postponement costly and inconvenient for Nike

Whilst Nike has seemingly managed to mitigate the threats of the COVID-19 pandemic to its business, one way in which COVID-19 has had a significantly negative effect on Nike is the postponement of Euro 2020.

Nike has been the most affected kit supplier by the postponement, supplying kits for 8 teams in the tournament, the most of any kit supplier, including France, England, Portugal and the Netherlands. Nike were set to release the kits for their sponsored teams in March, however these have been forced into delay. Nike would have been well advanced in its manufacturing and distribution processes given the need to freight its products from factories in Asian markets like China and Pakistan.

According to Sportcal’s Intelligence Centre, Nike’s contract with the Polish Football Association is set to expire after the previously scheduled tournament date for Euro 2020, whilst Nike’s contracts with Turkey, Croatia and Finland are labelled at ‘multi-year’ with no contractual details regarding length released to the public. This leaves the potential for Nike to be sitting on stock for national teams they may not have under contract.

Andy Korman, senior sponsorship consultant at The Sports Consultancy (and partner at its legal service, TSC Legal), said that contracts will differ, with some having exact stop dates, such as July 31, 2020, whereas others may stipulate the end of the contract as one week after the European Championships, which would protect the kit supplier. He is advising his clients to examine their contracts for the above, as well as for force majeure clauses, and to be ready to make “realistic commercial compromises”. These could include reduced rates for the extra year, enhanced renewal terms or more generous use of player assets during the term[12].

Appendix

Primary

GlobalData, Consumer Intelligence Centre

Sportcal Sponsorship Intelligence Centre

Sportcal News

Secondary

[1] https://www.forbes.com/sites/kurtbadenhausen/2016/12/02/cristiano-ronaldos-1-billion-nike-deal-is-a-bargain-for-sportswear-giant/#372cfb485a91

[2]https://www.businessinsider.com/nike-jordan-brand-rise-and-fall-history-2019-5?r=US&IR=T#collaborations-are-what-people-want-now-cohen-said-so-jordan-brand-is-collaborating-on-iconic-styles-with-some-of-the-biggest-names-in-fashion-like-with-its-2017-retro-high-og-friends-and-family-shoe-with-colette-in-paris-50

[3] https://www.businessinsider.com/how-michael-jordan-spends-his-money-2015-3?r=US&IR=T#nikes-jordan-brand-alone-now-brings-in-roughly-3-billion-in-revenue-each-year-15

[4] https://www.forbes.com/sites/kurtbadenhausen/2019/08/28/the-nbas-richest-shoe-deals-lebron-kobe-and-durant-are-still-no-match-for-michael-jordan/#4082f4043d02

[5] https://www.soccerbible.com/news/2020/05/the-michael-jordan-effect-its-influence-on-football/

[6] https://gumgum.com/newsroom/in-the-news/nike-and-jordan-logos-appear-over-100-times-in-a-single-episode-of-the-last-dance

[7] https://www.cnbc.com/2020/05/18/michael-jordans-stock-soars-after-the-last-dance.html

[8] https://www.forbes.com/sites/shelleykohan/2020/06/12/adidas-lags-behind-nike-and-puma-in-terms-of-diversity-and-inclusion/#357be47179f6

[9] https://www.fastcompany.com/90399316/one-year-later-what-did-we-learn-from-nikes-blockbuster-colin-kaepernick-ad

[10] https://www.marketwatch.com/story/adidas-reports-95-profit-fall-in-first-quarter-2020-04-27

[11] https://www.fool.com/investing/2020/06/03/why-shares-of-foot-locker-hanesbrands-and-under-ar.aspx

[12] https://www.sportbusiness.com/news/nike-postpones-euro-2020-national-team-kit-launches-as-contracts-scrutinised/