One month out from the tournament, GlobalData’s sport data team estimates that media rights revenue for the UEFA Women’s Euro 2025 national teams’ competition has hit $99.54 million, an increase of 142% from the 2022 edition (€37.5 million; $41.03 million).

Although most deals have already been signed ahead of the tournament, late deals in key women’s soccer markets Japan and China could see total media rights revenue break the $100 million barrier for the first time, a remarkable increase for a property that just 20 years ago only attracted €3.9 million ($4.27 million) of gross revenue (media rights, commercial rights and tickets & revenue).

Access deeper industry intelligence

Experience unmatched clarity with a single platform that combines unique data, AI, and human expertise.

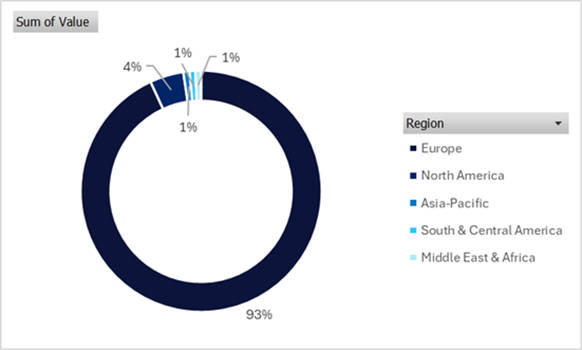

With the commercial strength of women’s soccer growing across Europe, it is no surprise that 93.11% of the estimated broadcast revenue for the tournament will come from the continent ($92.67 million).

The favourable time difference, especially compared to the FIFA Women’s World Cup 2023 in Australia, as well as a larger number of UEFA members qualifying for the tournament itself (16 versus 11 at the World Cup), helps draw in the casual viewer to boost audience figures, a key metric for broadcasters looking to get strong value for money in a competitive media rights landscape.

A captive local market resulted in the success of UEFA Women’s Euro 2022, which has emboldened governing body UEFA’s desire to push for increasingly higher media rights fees for the 2025 tournament.

The 2022 edition attracted a record cumulative global live audience of more than 365 million across 31 matches (the second consecutive edition with 16 teams), more than double that for the previous event in 2017, which drew 178 million (a figure the 2022 tournament surpassed during the quarter-final stage), and 214% higher than the 2013 edition (115 million; 12 teams contesting 25 matches total).

US Tariffs are shifting - will you react or anticipate?

Don’t let policy changes catch you off guard. Stay proactive with real-time data and expert analysis.

By GlobalDataMembers of the European Broadcasting Union (EBU) were responsible for a record total cumulative viewing figure of 280 million, with member broadcasters showing a cumulative total of over 1,200 hours. The final alone attracted a cumulative live viewership of 50 million worldwide, which was over three times more than the 2017 showpiece.

UEFA Women’s Euro 2022 viewing figures in selected markets

| Territory | Audience |

|---|---|

| United Kingdom | 16.9 million |

| Germany | 17.9 million |

| France | 3.2 million |

| Norway | 0.4 million |

| Netherlands | 1.9 million |

| Austria | 0.9 million |

| Iceland | 0.1 million |

These impressive viewing figures underpin a sharp growth in media revenue in markets with a historical interest in the women’s game. For example, news outlet L’Equipe reported that French commercial broadcaster TF1 acquired UEFA Women’s Euro 2025 rights in France, Monaco and French overseas territories for €20.0 million ($21.07 million), a marked increase on France Télévisions and M6’s deals for the FIFA Women’s World Cup 2023 (€3.0 million; $4.0 million apiece) and comparable to their rights fee for the domestic World Cup in 2019 (a tournament which featured an additional 21 matches).

Strong media rights values have also been agreed in Germany ($23.26 million), the United Kingdom ($16.05 million), Spain ($10.03 million) and the Netherlands ($3.50 million), together with robust figures in Scandinavia (Sweden: $1.84 million; Norway: $1.43 million; Denmark: $1.13 million; Finland: $0.72 million; Iceland: $0.06 million).

A notable showing from tournament debutant Poland ($1.00 million), a country with a track record in broadcasting women’s sport thanks to historical performances in tennis, handball and volleyball, helps to ensure that revenue driven from competing markets alone far surpasses the grand total from Euro 2022 (€37.5 million; $41.03 million).

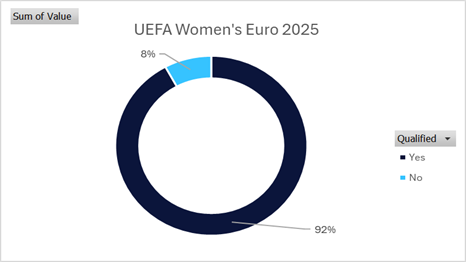

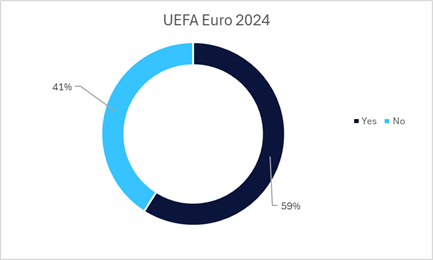

Media rights revenue from the 16 competing nations equates to 92.06% of the UEFA Women’s Euro 2025 total ($92.67 million), a marked difference from UEFA Euro 2024 where the proportion stood at 59.1% ($863.58 million). This does not come as a major surprise. The women’s game is not as developed as the men’s – only 196 sides have FIFA rankings, compared with 210 – and the lack of investment in the sport outside of those ranked in the top 20 means that interest and awareness is concentrated in a smaller group of nations.

This group narrows further for continental tournaments, where time difference and less awareness or interest due to a lack of national participation come into play, which limits the potential for a high rights fee from established women’s soccer nations such as the United States, Canada and Australia.

Whilst the women’s game continues to grow, it is yet to receive the global breakthrough that the men’s game has. The best domestic leagues do not have international TV rights deals to rival even minor men’s leagues and the best European women’s soccer players, including Alexia Putellas, Aitana Bonmati and Ada Hegerberg, are yet to receive the level of recognition within the sport that their male counterparts do.

The increased levels of recognition and global appeal allow the international tournaments in the men’s game to attain high interest levels outside of competing nations as teams and players are culturally significant, even among regions and demographics that may not be typically associated with soccer.

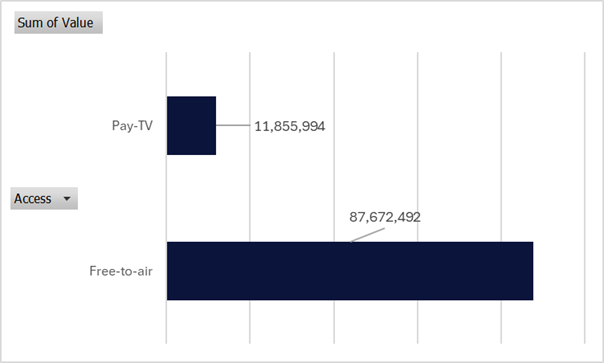

In signing a distribution deal with the European Broadcasting Union (EBU), the alliance of public-service broadcasters, UEFA have tried to address this problem by enabling as many European soccer fans as possible to watch games on a free-to-air basis as a way of growing an audience. In many nations the levels of interest in women’s soccer are not strong enough for pay-TV broadcasters to justify bidding for the rights and an inability to secure consistently large audience figures for an entire tournament means they’re unable offer competitive rights fees due to a need to breakeven/profit from their initial investment.

Even if these markets mature in future years, the national interest that international tournaments bring – as shown by the ever-increasing viewing figures – is likely to pressurise UEFA into keeping as many games as possible available on a free-to-air basis, so as not to alienate an audience they’ve worked hard on cultivating.

In a sport that has historically prioritised the men’s game, UEFA have successfully grown the media footprint of the UEFA Women’s Championship at great speed. With an ever-increasing number of fans and broadcasters looking to get involved with the game, there is reason to believe that rights fees for the tournament will continue to climb.

As the tournament moves towards guaranteeing a large audience, tender processes will become more competitive, driving revenue higher. Media rights fees for the tournament have grown 838.17% since the 2017 edition (€9.70 million; $10.61 million) but are still significantly lower than the men’s equivalent (Euro 2024: $1.46 billion according to GlobalData estimates), meaning there remains the potential for sharp growth to continue for future editions of the competition as it gains a stronger foothold among sports fans across the globe.

This piece was written in conjunction with figures modelled through GlobalData Sport’s media rights calculator, a proprietary tool which considers factors including national demographics and sports popularity plus weightings for access (free-to-air vs. pay-TV), broadcast (linear television vs. streaming) and coverage (live vs. highlights), to calculate a value for individual territories/regions.

Reported figures are also used where available. GlobalData Sport’s media rights calculator has previously been used to estimate media rights revenue of the UEFA European Championship 2024, Olympic Games 2024, Rugby World Cup 2023, as well as the annual golf majors, tennis grand slams and Europe’s big five soccer leagues.

The $ conversions of € figures relating to previous editions of the UEFA Women’s European Championship were calculated using the €-$ exchange rate from the publication date of the UEFA Financial Report 2022/23 (30 June 2023).

The $ conversion of € figures relating to French rights deals for UEFA Women’s European Championship 2025 and FIFA Women’s World Cup 2023 were calculated using the €-$ exchange rate from the date the deals were announced (28 September 2023 & 14 June 2023, respectively).