Search Results

Answer created by AI

- Like

- Disike

AI result is experimental

Generating Answer...

-

Sectors (16622)

-

Soccer (4053)

-

Olympics (3199)

-

Business (2145)

-

Motor Racing (1298)

-

Motorsport (1263)

-

Rugby Union (1157)

-

Cricket (1072)

-

Tennis (743)

-

Golf (737)

-

Basketball (687)

-

Athletics (659)

-

Multi-sport games (521)

-

American Football (403)

-

Sailing (323)

-

Ice hockey (318)

-

Motorcycling (306)

-

Cycling (273)

-

Rugby League (269)

-

Waterskiing (265)

No Filter Selected

-

Press Releases (18730)

-

News Analysis and Comments (6592)

-

White Papers (9)

-

Suppliers (1)

No Filter Selected

-

United States (1241)

-

United Kingdom (761)

-

Switzerland (331)

-

Germany (315)

-

France (308)

-

Spain (297)

-

Australia (288)

-

Italy (234)

-

England (217)

-

Europe (178)

-

India (173)

-

Global (143)

-

Canada (115)

-

New Zealand (111)

-

Saudi Arabia (109)

-

Ireland (104)

-

Brazil (96)

-

London (90)

-

China (85)

-

Japan (83)

No Filter Selected

-

Cricket (10)

-

Motor racing (10)

-

N (16)

-

Soccer (91)

No Filter Selected

-

1. FC Koln (1)

-

1899 Hoffenheim (1)

-

AC Milan (1)

-

AC Monza (1)

-

AFC Bournemouth (1)

-

AS Monaco (1)

-

AS Roma (1)

-

Alfa Romeo F1 Team (1)

-

Alpine F1 Team (1)

-

Arsenal FC (1)

-

Aston Martin F1 Team (1)

-

Aston Villa FC (1)

-

Atalanta (1)

-

Athletic Bilbao (1)

-

Atletico Madrid (1)

-

Bayer Leverkusen (1)

-

Bayern Munich (1)

-

Bologna (1)

-

Borussia Dortmund (1)

-

Borussia Monchengladbach (1)

No Filter Selected

-

Bundesliga (15)

-

Formula 1 (10)

-

IPL (10)

-

La Liga (21)

-

Ligue 1 (17)

-

N (16)

-

Premier League (19)

-

Serie A (19)

No Filter Selected

-

AIX Investment Group (1)

-

AMX (1)

-

AOC (1)

-

Adesital (1)

-

Adobe (1)

-

Alila Group (1)

-

Allianz (2)

-

Alpha Gel (1)

-

Alua Hotels & Resorts (1)

-

Ambilight TV (1)

-

Applied Nutrition (1)

-

Aratravel (1)

-

Arborea (1)

-

Arctic Wolf (1)

-

Arena e Calvino (1)

-

Argenta Ceramica (1)

-

Aroundtown (1)

-

Asahi Super Dry (1)

-

Aspetar (1)

-

Astral Pipes (1)

No Filter Selected

-

3D Printing (1)

-

Artificial Intelligence (3)

-

Cloud (4)

-

Corporate Governance (2)

-

Covid-19 (1)

-

Cybersecurity (2)

-

Environmental Sustainability (3)

-

Internet of Things (7)

-

Other Innovation Areas (4)

-

Robotics (3)

-

Social Responsibility (4)

-

Virtual Reality (1)

-

Virtual and Augmented Reality (1)

No Filter Selected

Drone racing: flight of fancy?

Like eSports, the emergence of drone racing and the ensuing hype around it divides industry opinion. Sportcal Insight takes a look at some of the numbers being thrown around at the Drone Racing League finale.

England's T20 gamble

The commissioning of a new Twenty20 cricket tournament in England in 2017 has been controversial. The England and Wales Cricket Board and the county teams are behind the decision but are they taking too much of a gamble?

Jason McCracken

Jason McCracken, CEO of field hockey’s FIH, tells Sportcal Insight about plans to make the new Hockey Pro League a commercial success, and his early months in the job.

Brands face a tricky balancing act between capitalising on the global platform provided by the World Cup and the need to be sensitive to political tensions

Top five brand issues at Fifa World Cup

Reinventing eventing

Event Rider Masters is the new kid on the block trying to shake up the venerable sport of eventing. Sportcal Insight ponders its chances of success.

GSI Report 2017 - Sporting Impact

Sport continues to generate enormous holistic benefits for host cities and nations but more needs to be done to understand and express these benefits and the fans that engage with these events.

Private equity - Coming to a team near you?

Euan Cunningham analyses the rise to prominence of private equity money in the sports investment landscape.

Steve Martin

There are ever more agencies in sports marketing, but still “plenty of business” for the most successful, while sponsors are increasingly open to creative campaigns, says Steve Martin, global chief executive of UK-based M&C Saatchi Sport & Entertainment.

Le Tour targets Germany

Staging this year’s Tour de France Grand Départ in Düsseldorf in Germany was no accident, says ASO’s head of marketing Laurent Lachaux

Chinese global event sponsors

Changes to the line-up of sponsors for the world's major sporting events in recent years reflect the growing influence of Asia and the location of forthcoming Olympic Games, and the shift eastwards shows no sign of abating - especially if, as seems likely, China is awarded the Fifa World Cup for the first time.

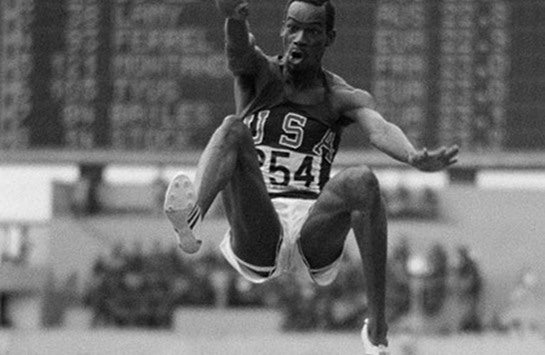

The image that changed the game

Getty Images is celebrating the founding of Allsport, the world’s first sports photography agency which went on to become Getty Images Sport. The agency takes Sportcal Insight through the huge changes in 50 years of sports imagery.

Finding the balance between compelling and engaging design, and good user experience through the speedy delivery of content will put your website top of the league

Site speed: balancing web design and efficiency

- 1

- 2

- 3

- 4

- 5

- 6

- 7

- 8

- 9

- 10

- 11

- 12

- 13

- 14

- 15

- 16

- 17

- 18

- 19

- 20

- 21

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 34

- 35

- 36

- 37

- 38

- 39

- 40

- 41

- 42

- 43

- 44

- 45

- 46

- 47

- 48

- 49

- 50

- 51

- 52

- 53

- 54

- 55

- 56

- 57

- 58

- 59

- 60

- 61

- 62

- 63

- 64

- 65

- 66

- 67

- 68

- 69

- 70

- 71

- 72

- 73

- 74

- 75

- 76

- 77

- 78

- 79

- 80

- 81

- 82

- 83

- 84

- 85

- 86

- 87

- 88

- 89

- 90

- 91

- 92

- 93

- 94

- 95

- 96

- 97

- 98

- 99

- 100

- 101

- 102

- 103

- 104

- 105

- 106

- 107

- 108

- 109

- 110

- 111

- 112

- 113

- 114

- 115

- 116

- 117

- 118

- 119

- 120

- 121

- 122

- 123

- 124

- 125

- 126

- 127

- 128

- 129

- 130

- 131

- 132

- 133

- 134

- 135

- 136

- 137

- 138

- 139

- 140

- 141

- 142

- 143

- 144

- 145

- 146

- 147

- 148

- 149

- 150

- 151

- 152

- 153

- 154

- 155

- 156

- 157

- 158

- 159

- 160

- 161

- 162

- 163

- 164

- 165

- 166

- 167

- 168

- 169

- 170

- 171

- 172

- 173

- 174

- 175

- 176

- 177

- 178

- 179

- 180

- 181

- 182

- 183

- 184

- 185

- 186

- 187

- 188

- 189

- 190

- 191

- 192

- 193

- 194

- 195

- 196

- 197

- 198

- 199

- 200

- 201

- 202

- 203

- 204

- 205

- 206

- 207

- 208

- 209

- 210

- 211

- 212

- 213

- 214

- 215

- 216

- 217

- 218

- 219

- 220

- 221

- 222

- 223

- 224

- 225

- 226

- 227

- 228

- 229

- 230

- 231

- 232

- 233

- 234

- 235

- 236

- 237

- 238

- 239

- 240

- 241

- 242

- 243

- 244

- 245

- 246

- 247

- 248

- 249

- 250

- 251

- 252

- 253

- 254

- 255

- 256

- 257

- 258

- 259

- 260

- 261

- 262

- 263

- 264

- 265

- 266

- 267

- 268

- 269

- 270

- 271

- 272

- 273

- 274

- 275

- 276

- 277

- 278

- 279

- 280

- 281

- 282

- 283

- 284

- 285

- 286

- 287

- 288

- 289

- 290

- 291

- 292

- 293

- 294

- 295

- 296

- 297

- 298

- 299

- 300

- 301

- 302

- 303

- 304

- 305

- 306

- 307

- 308

- 309

- 310

- 311

- 312

- 313

- 314

- 315

- 316

- 317

- 318

- 319

- 320

- 321

- 322

- 323

- 324

- 325

- 326

- 327

- 328

- 329

- 330

- 331

- 332

- 333

- 334

- 335

- 336

- 337

- 338

- 339

- 340

- 341

- 342

- 343

- 344

- 345

- 346

- 347

- 348

- 349

- 350

- 351

- 352

- 353

- 354

- 355

- 356

- 357

- 358

- 359

- 360

- 361

- 362

- 363

- 364

- 365

- 366

- 367

- 368

- 369

- 370

- 371

- 372

- 373

- 374

- 375

- 376

- 377

- 378

- 379

- 380

- 381

- 382

- 383

- 384

- 385

- 386

- 387

- 388

- 389

- 390

- 391

- 392

- 393

- 394

- 395

- 396

- 397

- 398

- 399

- 400

- 401

- 402

- 403

- 404

- 405

- 406

- 407

- 408

- 409

- 410

- 411

- 412

- 413

- 414

- 415

- 416

- 417

- 418

- 419

- 420

- 421

- 422

- 423

- 424

- 425

- 426

- 427

- 428

- 429

- 430

- 431

- 432

- 433

- 434

- 435

- 436

- 437

- 438

- 439

- 440

- 441

- 442

- 443

- 444

- 445

- 446

- 447

- 448

- 449

- 450

- 451

- 452

- 453

- 454

- 455

- 456

- 457

- 458

- 459

- 460

- 461

- 462

- 463

- 464

- 465

- 466

- 467

- 468

- 469

- 470

- 471

- 472

- 473

- 474

- 475

- 476

- 477

- 478

- 479

- 480

- 481

- 482

- 483

- 484

- 485

- 486

- 487

- 488

- 489

- 490

- 491

- 492

- 493

- 494

- 495

- 496

- 497

- 498

- 499

- 500